LATEST NEWS

April 17, 2024

Slovenia medicine tenders added to Pharma14

In Slovenia, medicine tenders play a crucial role in ensuring the availability of high-quality pharmaceuticals and healthcare products across the country. These tenders are typically organized and overseen by various governmental bodies, such as the Ministry of Health or the Health Insurance Institute of Slovenia (HIIS), with the aim of procuring medications and medical supplies for public healthcare institutions, including hospitals, clinics, and pharmacies.

However, medicine tenders in Slovenia, like in any other country, can also face challenges and criticisms. Some concerns may include issues related to accessibility, particularly for smaller pharmaceutical companies, as well as potential delays in the procurement process that could impact the timely availability of essential medications. Additionally, ensuring transparency and integrity throughout the tendering process is essential to prevent corruption and ensure public trust in the healthcare system.

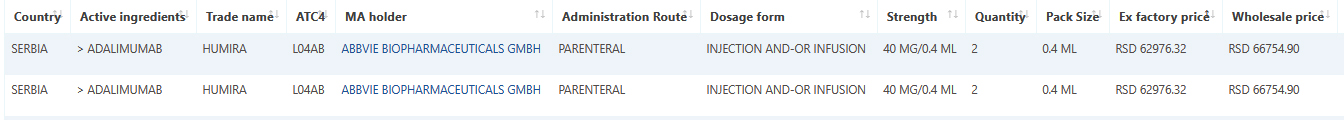

Sample data: Adalimumab Slovenia tender results.

December 01, 2023

Slovakia medicine tender results covered now by Pharma14

Slovakia's medicine tender market, a key arena for business development, is witnessing a surge in demand due to the government's focus on healthcare accessibility. The transparent procurement processes create opportunities for businesses, with tenders being a primary channel for pharmaceutical distribution to healthcare institutions.

Understanding the regulatory landscape, pricing dynamics, and competition is crucial for success in this market. The Slovakian government's commitment to transparent procurement practices ensures a level playing field, presenting a lucrative space for pharmaceutical companies.

With the market evolving, businesses should align their strategies with the country's healthcare priorities. The sizeable tender market, valued in Euros, is indicative of the potential for growth and collaboration. For success, businesses must build strong relationships, stay informed about regulations, and deliver high-quality, competitive products.

Pharma14 is now tracking Slovakia tender results with monthly updates.

Besides Slovakia tender data, Pharma14 tracks other tender markets such as Spain, Italy, Portugal, Greece, Sweden, US and many more.

Sample data: Infliximab and Trastuzumab tender results.

November 01, 2023

Greece medicine tender market covered now by Pharma14

The market size in the pharmaceutical tender market is primarily determined by the volume and value of medicines and healthcare products procured through public tenders. These tenders are issued by various government entities, including the Greek National Organization for Healthcare Provision (EOPYY), the Ministry of Health, and regional healthcare authorities. These tenders cover a wide range of pharmaceutical products, from generic medications to specialty drugs and medical devices.

The pharmaceutical tender market's size can vary based on several key factors:

Government Budgets: The market size is closely tied to the public healthcare budget allocated by the Greek government. Fluctuations in healthcare spending can influence the volume and value of tenders.

Disease Prevalence: The prevalence of specific diseases and health conditions can affect the demand for certain pharmaceutical products, impacting the size of tenders related to those products.

Regulatory Changes: Changes in healthcare policies and regulations can lead to adjustments in the tendering process, which may, in turn, impact the market size.

Economic Conditions: Economic stability and growth can have an indirect effect on healthcare budgets and consequently influence the size of pharmaceutical tenders.

Market Competition: The level of competition among pharmaceutical companies in Greece can impact the number of participants in tenders and the final market size.

Pharma14 is now tracking Greece tender results with monthly updates.

Besides Greece tender data, Pharma14 tracks other tender markets such as Spain, Italy, US and many more.

Sample data: Imatinib tender results.

October 01, 2023

Malta medicine tender market

The medicine tender market in Malta is a critical component of the country's healthcare system, ensuring the accessibility and affordability of pharmaceuticals for its citizens. With a focus on transparency and competition, Malta conducts regular tenders to procure a wide range of medicines, medical devices, and healthcare products. These tenders are typically open to both local and international pharmaceutical companies, fostering a competitive environment that benefits patients and the healthcare industry alike. The Maltese government's commitment to stringent quality standards and cost-effectiveness in these tenders ensures that the population receives high-quality healthcare while managing healthcare costs efficiently.

While Malta may not be the largest player in the global medicine world, its strategic location, regulatory framework, healthcare infrastructure, and pharmaceutical industry contribute to its importance in the field of medicine and healthcare, both regionally and internationally.

Pharma14 is now tracking Malta tender results with monthly updates.

Besides Malta tender data, Pharma14 tracks other tender markets such as Spain, Italy, US and many more.

Sample data: Alfacalcidol tender results.

September 01, 2023

Inequality of Pharmaceutical availability across differing countries

The availability of medications in Eastern Europe has been affected by differences in the medicine registration process of the region, compared to the EU.

The EU uses a single marketing authorization from the European Medicines Agency (EMA), which is valid in all EU member states, streamlining the process for pharmaceutical companies to bring their products to market.

The process and requirements for medicine registration in Eastern Europe can also differ from those in the EU. As a result, some medications may be available later, or not at all, in Eastern Europe compared to the EU. This can impact access to innovative treatments for patients in the region - Romania, for example does not have 8,995 molecules that are registered MA’s in the EU27.

In recent years, some Eastern European countries have been working to align their regulatory systems with EU standards in order to reduce disparities in the availability of medications, and ultimately improving patient access (the Joint Baltic Drug Procurement Agreement between the Baltic states is an example of this). This effort to coordinate regulations across the region will help to support the development of an integrated market for pharmaceuticals in Eastern Europe.

Pharma14 new MARKET OPPORTUNITY LOCATOR feature can list the anomalies in medicines across any markets selected.

As a business development individual this new feature can give great insight into unique business opportunities between markets of your choice.

Sample data query: “Show me all molecules not registered in Romania but are present in the EU27”

August 01, 2023

Spanish medicine tender results are latest addition to the Pharma14 platform

The Spanish medicine tender market is a significant part of the country's public health system, with a total market size estimated at around €12 billion. The majority of this spending is on pharmaceutical products, which account for more than two-thirds of the total market.

The tendering process for these pharmaceutical products is highly competitive, with numerous suppliers vying for contracts. The value of individual tenders can vary widely, ranging from a few thousand euros for small-scale purchases to millions of euros for large-scale procurement.

The amount paid out by regions in Spain for tenders can also vary significantly. The largest regions, such as Madrid and Catalonia, have the highest spending power, and thus tend to have larger budgets for purchasing medical supplies. In contrast, smaller regions such as La Rioja and Cantabria have lower budgets and tend to make smaller purchases.

The Spanish government has taken steps in recent years to improve the efficiency and effectiveness of the tendering process. This has included the introduction of electronic tendering systems, which have streamlined the process and improved transparency. The government has also taken steps to promote innovation in the market, with a focus on encouraging the development of new and more effective medical products.

Pharma14 is now covering the tender results in Spain with regular monthly updates.

Sample data: Spanish tender sample data results from ATC group L01XK.

April 14, 2023

Bulgaria medicine tender results

The medicine tender market in Bulgaria is a significant part of the healthcare system, with a total size of approximately €500 million. Public hospitals, clinics, and other healthcare institutions regularly organize tenders to procure medicines, medical supplies, and equipment from various suppliers. These tenders are usually awarded based on criteria such as price, quality, and delivery time. The market is highly competitive, with both local and international suppliers participating in the tenders. The Bulgarian government has been implementing measures to increase transparency and reduce corruption in the tendering process, which is expected to further boost market growth.

According to a report by the Bulgarian Ministry of Health published in 2020, the largest volume of medicines procured through tenders were for drugs used to treat cardiovascular diseases, followed by drugs for the nervous system, and drugs for the digestive system. In terms of value, the report stated that the most expensive drugs purchased through tenders were those used in the treatment of cancer.

Pharma14 is now covering the tender results in Bulgaria with monthly updates.

April 02, 2023

Inequality of Pharmaceutical availability across differing countries

The availability of medications in Eastern Europe has been affected by differences in the medicine registration process of the region, compared to the EU.

The EU uses a single marketing authorization from the European Medicines Agency (EMA), which is valid in all EU member states, streamlining the process for pharmaceutical companies to bring their products to market.

The process and requirements for medicine registration in Eastern Europe can also differ from those in the EU. As a result, some medications may be available later, or not at all, in Eastern Europe compared to the EU. This can impact access to innovative treatments for patients in the region - Romania, for example does not have 8,995 molecules that are registered MA’s in the EU27.

In recent years, some Eastern European countries have been working to align their regulatory systems with EU standards in order to reduce disparities in the availability of medications, and ultimately improving patient access (the Joint Baltic Drug Procurement Agreement between the Baltic states is an example of this). This effort to coordinate regulations across the region will help to support the development of an integrated market for pharmaceuticals in Eastern Europe.

Pharma14 new MARKET OPPORTUNITY LOCATOR feature can list the anomalies in medicines across any markets selected.

As a business development individual this new feature can give great insight into unique business opportunities between markets of your choice.

January 01, 2023

Latvian pharmaceutical tender market

Latvian Pharmaceutical Market and Medicine Tender Process The Latvian pharmaceutical market is sizeable comparative to its population and economic status. The market’s total value in 2021 was €442.5 million ($479.82 million), which was a decrease of 1.12% from previous year (approx. €5 million) due to the various impacts COVID-19 had on this market. In 2018, Latvia was 26th out of the 28 EU countries for annual market value, between Lithuania at €635 million ($689 million) and Estonia €299 million ($325 million). The CAGR is expected to be 8.75% up to 2030, where the market value is predicted to reach €2.35 billion ($2.55 Billion). Despite universal coverage through state funding, 37.1% of coverage is out-of-pocket, over double the European average (15%) and one of the highest rates on the continent. Much of this includes pharmaceutical procurement.

Despite this, the tender process is primarily influenced by the state, as well as through the Joint Baltic Drug Procurement Agreement, in which all member states (including Lithuania, Estonia and Latvia) subsidies specific drugs, in particular those which treat diabetes, HIV and Tuberculosis. Drug wholesalers determine prices by multiplying the manufacturer’s price by a correction factor, adding the correction sum and a VAT of 12%. The correction factor and the correction sum are determined on the basis of the manufacturer’s price. Once these pharmaceuticals are procured, they are added to a positive reimbursement list, which reimburses the service user 100%, 75% and 50% respectively. Where specific medication is listed is based on the disease it treats and how important that medication for vital functions of the patient; medication for rheumatoid arthritis, for example, is on list A, and is fully reimbursed. This only applies for outpatient services, however, as inpatient prescriptions are free of charge. Inpatient medication is procured by the health service provider directly, which is under the direct management of the Ministry of Health, which typically includes larger secondary and tertiary care centers. Smaller hospitals are controlled by municipalities, but 80% of these, as well as primary care centers, are privately owned.

Pharma14 tracks the Latvian monthly tender landscape.

Sample data: Dinutuximab Beta and Treprostinil January 2023 tender data.

November 15, 2022

Italian public medicine tender market

Italian public medicine tender market

Italy's pharmaceutical market is one of the largest and most advanced markets in Europe and in the world. In 2021, Italy had ranked 3rd in size of pharmaceutical production in Europe, behind Switzerland and France, and had also ranked 3rd in sheer market value at ex-factory prices. Italy's pharmaceutical market is expected to grow at a CAGR rate of 3.9% between 2022-2027. Italy is also a leading country in research, hosting nearly 20% of all authorized clinical trials in the EU. Furthermore, Italy's Total health expenditure as a share of GDP stands at 9.9%, above the EU average of 8%.

the Italian procurement market showed a value exceeding 185 billion Euro during the year 2019, represented by 162,113 contracts. Of these contracts, nearly half were related to the healthcare sector, and about 33% were accounted for the procurement of medicines. However, procurement procedures are used only by hospitals and health-centers, in the procurement of the medicines used in their facilities. All health-related public procurements are subject to the rules laid out by the PPC- the Public Procurement Code, which implements and withholds the main EU directives and national agenda to the matter.

Pharma14 tracks the public tender results in Italy on a monthly basis.

Sample Data:

Inlyta (Axitinib) procurement pricing results in Italian public sector for September 2022.

November 01, 2022

New Zealand vs. Australia medicine consumption data

New Zealand vs. Australia medicine consumption data.

The New Zealand pharmaceutical market is one of the major pharmaceutical markets of the Southwestern Pacific region that increased from $0.7B in 2011 at a Compound Annual Growth Rate (CAGR) of 8% to $1.02B in 2019, and is forecast to reach about $1.56B in 2025. New Zealand’s medicines expenditure per capita in 2019 stands at $4211.05 compared to Australia at $5,427.46, Canada at $5,048.37 and the UK at $4,312.89.

Current health expenditure (% of GDP) in NZ stands at 9.74%, Australia at 9.91%, Canada at 10.84%, and the UK at 10.15%.

However, despite the ongoing growth in its market value and in expenditure per capita, the supply side of the New Zealand pharmaceutical market has been defined as an oligopolistic structure. Since the local manufacturing base is small and production is insufficient, many pharmaceuticals are imported from European, Australian and North American manufacturers. The New Zealand pharmaceutical market is dominated by its public health system, so the public funding system may be attractive for the pharmaceutical industry.

In addition, New Zealand has one of the highest proportions of generic medicines by volume (third out of 26 OECD countries).

Since the introduction of the use of generic drugs instead of their originators is an effective way to rationalize healthcare, generic pharmaceutical industry will be an important part of the drug policy in New Zealand in the near future.

We are happy to announce that Pharma14 has added New Zealand to its platform, now showcasing medicine data, pricing and consumption information of 68 countries throughout Europe, northern and southern America, Asia and the southwestern pacific region.

.

Sample data: Comparing Lenalidomide consumption. New Zealand vs. Australia

October 15, 2022

Poland pharmaceutical market size

Poland pharmaceutical market size

Poland has one of the largest pharmaceutical markets in Europe. It is the 5th largest pharmaceutical market in the EU, and the largest pharmaceutical market in central Europe. Poland's pharmaceutical market was valued at 10 billion USD in 2021, and has been growing at a rate of 5.2% CAGR between the years 2013 to 2019. However, due to the COVID-19 pandemic, the accelerated growth previously noted dropped to a 2% CAGR in 2020. The pharmaceutical industry in Poland generates about 1.7% of the country's total GDP.

Poland's pharmaceutical manufacturing focal point is generic medicine. With a predicted 7% CAGR in production of generic medicine, compared with 5.9% CAGR in OTC production, and 2.7% CAGR in innovative medicine production (2017-2025). The Polish health care system relays mostly on generic medicine, as a means to reduce costs. However, in recent years there has been a shift towards implementing more biologic medicines in the national reimbursement scheme. Hospital spending on high-priced biological medicines has increased rapidly from 6.8% in 2018, to 17.1% this year.

Pharma14 tracks the Polish market closely in terms of medicine pricing, consumption, shortages, EU parallel trade as well as constant market competitive analytical tools.

Sample Data:

Insulin Glargine pricing, consumption levels for 2021 and current shortage issues in Polish market.

October 01, 2022

Bulgarian pharmaceutical market, reimbursement, pricing and consumption information

Bulgarian pharmaceutical market, reimbursement, pricing and consumption information.

The Bulgarian pharmaceutical market has been steadily growing over the past few years, with $ per capita growing at a CAGR of 3.1% since 2018, reaching roughly 1.4 billion USD in 2021. Governmental expenditure in the health sector has also been increasing, and in 2022 the national healthcare budget had set itself a new record at 4 billion USD, in addition to the budget for drugs, also reaching a record at 1.2 billion USD. In the year 2021, Bulgaria spent 8.1% of its GDP on healthcare, and by doing so passed the EU threshold of 8%. The growth is mainly attributed to the development of the hospital sector, which grew by 25%, reaching roughly 500 million USD. The pharmacy market segment also grew by 5.8% amounting to 2 billion USD in revenue. The governmental body responsible for examining drugs and medical devices to be launched in Bulgaria is the BDA (Bulgarian drug agency), which has received from the FDA confirmation of manufacturing and inspection at a level equivalent to the U.S. standard.

The public procurement sector amounts to 15% of total GDP in Bulgaria, with the two main fields being construction and health. Roughly 20% of Bulgarian procurement contracts in 2022 are health related, of which over 50% are contracts for the procurement of pharmaceuticals.

Pharma14 tracks the Bulgarian market with monthly updates including MA holder, manufacturer data, reimbursed consumption and pricing data.

Sample Data:

2019-2021. Adalimumab - Humira, pre-filled syringe 40 mcg/04. ml, X2 consumption data (reimbursed).

Sample Data:

Current Adalimumab pricing data (November 2022)

September 15, 2022

Pharma14 team will be attending the CPHI Frankfurt, November 1-3 2022

Pharma14 team will be attending the CPHI Frankfurt, November 1-3.

We are pleased to let you know that we are attending the CPHI in Frankfurt; November1-3.

If you will be attending and would like to set up a meeting please let us know.

We will also be available for virtual meetings once the show ends.

If you cannot meet us there or schedule a call during the virtual period please let us know and we can find an alternate day.

Pharma14 HIGHLIGHTS:

• 68 full country medicine database. https://www.pharma14.com/StaticPages/Features

• 2,500,000 medicines (Rx and OTC) - full information about each drug including - Ex-factory, Wholesale and retail prices + reimbursed information.

• Active ingredients, ATC code classification, administration routes, strength, trade names, MA holder information, leaflets in PDF format and much more.

• Niche market product locator.

• Market Opportunity Locator business tool. Live track the molecules with the least competition per country.

• Consumption and sales data for USA, EU5, Scandinavia, Baltics, Canada and more.

• Full European parallel import information. EMA and National levels.

• National medicine shortages tracker.

• First approval date and marketing authorizations for all molecules from USA, Europe.

• Standard monthly updates.

• Excel downloads.

• Real manufacturer information.

• Live track first generic registrations of patented medicines as they happen.

• Most competitive and affordable yearly membership costs!

Current Monthly Update Pharma14 Global Coverage

September 01, 2022

FDA and EMA Novel drug approvals 2022

Throughout 2022 we have seen a decrease in the number of novel drugs approved by the FDA and EMA compared to previous years. So far in 2022, 16 new drugs were approved by the FDA, a major decrease from the previous year, in which 27 new medicines were approved till July and 50 approved throughout the year. The trend seems to be similar in the EU, where 12 new medicines were approved by the EMA, compared to 20 approvals by the same time last year.

The one drug that stands out in terms of projected sales is Mounjaro, a treatment for adults with type 2 diabetes marketed by Eli Lilly. This treatment has been approved by the FDA in May, and has been recommended for market authorization by the EMA’s human medicines committee (CHMP) in July. Mounjaro proved efficient in the treatment of type 2 diabetes, and according to Eli Lilly, has also helped obese recipients lose over 20 percent of their body weight. The peak revenue for this drug is projected to reach between 8-20$ billion, depending if the drug will be used as a treatment for obesity as well as diabetes.

The following table portrays drugs approved by the FDA in 2022, and their status regarding the EMA:

Pharma14 tracks all new approvals in 68 countries. Tracking pricing levels consumption and much more.

Sample Pharma14 data: Mounjaro/Tirzepatide federal tender and state purchase level ex-factory prices.

August 15, 2022

Mexico tender market

Mexico has the second largest pharmaceutical market in Latin America after Brazil, and is ranked 12th in size globally. Valued at over 11$ billion USD in sales in 2020, Mexico is expected to grow over the next 10 years at a CAGR of around 6% and projected to top $13 billion USD in pharmaceutical sales by 2028. In terms of value, the private healthcare sector is the largest, followed by the public. Yet in terms of volume, the public healthcare market is larger than the private. In addition, Mexico's public healthcare system is employment-based, meaning there are 3 institutions providing healthcare services, covering about 95% of the population. The remaining 5% are covered by private healthcare insurance.

Currently there are 3 types of tenders that take place in Mexico: the first and largest one is the yearly tender, in which the governmental healthcare institutions procure both pharmaceuticals and medical devices. The second and third tenders are small tenders and direct pharma purchase tenders, conducted in case of supply shortages.

The yearly tender is meant to cover the national consumer healthcare sector. It's managed and supervised by the United Nations Office for Project Services (UNOPS), in charge of registration and bids. The Mexican institute in charge of coordinating and making demands to UNOPS is INSABI- Mexico's National Institute of Health for Wellbeing, one of the national healthcare institutions.

Pharma14 tracks the Mexican tender market.

Sample Pharma14 data: Bevacizumab and Rituximab tender ex-factory prices.

August 01, 2022

Swedish tender market update

The Swedish pharmaceutical market is one of the most progressive markets in the EU. Valued at 4.3 billion euros in 2019, Sweden's pharmaceutical market is 8th by size in Europe, with export of medicines listed at over 100 billion SEK (10B$) in 2021. Sweden spends about 11% of GDP on health and medical services and is set to register a CAGR of 3.9% over the forecast period (2022-2027).

Medical suppliers for the Swedish healthcare system are selected via a tendering process, in which the suppliers submit an application providing evidence of clinical effectiveness alongside their price, thus creating a competitive market. The procurement process is done within governmental framework agreements, used to supply basic terms and conditions that are withheld between the regions and the selected suppliers. The responsibility for health and medical care in Sweden is shared by the central government, in charge of approving reimbursement, the regions, and the municipalities. Sweden is divided into 21 regions, responsible for providing and procuring medicines and other medical services. They are also responsible for the distribution of resources to health services and for the overall planning of the services offered. The regions own and run the hospitals, health centers, and other institutions as well.

Pharma14 tracks the Swedish tender market closely.

Sample Pharma14 data: Pfizer's Benefix Coagulation factor IX pricing at tender vs. standard levels.

July 15, 2022

UK pharmaceutical reimbursement market

In 2020/21 UK government- financed healthcare expenditure stood at 213B GBP (256B$), a 15% increase since 2019/20 (177B GBP, 213B USD). Medicine spend by the NHS amounted to 8% Of the total government-financed healthcare expenditure, and stood at 17.1B GBP (20.5B$), a 5% increase from 16.8B GBP (20.2B$) in the year 2019/20. Medicine prescribed in primary care stood at 55% of medicine spend (9.4B GBP, 11.5B$), while the majority of the remaining expenditure (44.5%) were for medicines prescribed in hospitals (7.6B GBP, 9.2B$).

In the UK, the institute in charge of financing healthcare is the NHS. The value of a drug in the UK is appraised by a separate body – NICE. NICE reviews the clinical and other data prepared by the manufacturer and decides whether the NHS should reimburse the drug. The price of a drug seeking to be marketed in the UK is determined by negotiations between the NHS and the manufacturer.

The following graph portrays the types of drugs reimbursed, how much was spent on each sector, and whether the treatment was issued in hospitals or in primary care in the year 2020/21:

Pharma14 coverage of UK consumption is extensive, covering pharmacy and hospital products, including totals in units and total expenditure between the years 2018-2021.

Sample Pharma14 data: Pentasa (Mesalazine) 1G UK consumption 2018-2021

1G UK consumption 2018-2021. 15 July 2022.jpg)

July 01, 2022

Argentina Pharmaceutical Market

The Argentinian pharmaceutical market is the third largest pharmaceutical market in Latin America after Brazil and Mexico, and it accounts for 16% of the Latin American pharmaceutical market. The market was valued at 5.2 billion $ in 2021, and is at a growing rate of 5.4% CAGR since 2018. Argentina is one of the few countries in the world where the locally-owned laboratories’ presence and share in the domestic market are higher than the multinational laboratories, and currently 70% of pharmaceutical production in Argentina is generated by national laboratories.

In 2020 pharmaceutical imports to Argentina amounted to 2.2B$, a 2% decline from 2019, while exports amounted to 720M$, a 2.8% increase from 2019. This gap leaves a negative trade balance currently standing at -1.48B$, yet the market trend seems to be slowly aiming at a balance. Of the 2.2B$ in imports, roughly 700M$ (32%) account for biological medicines, while the remaining 1.5B$ (68%) account for the import of traditional medicines. Of the 720M$ exported, about 85M$ (11%) account for biological medicines, while 635M$ (89%) account for traditional medicines. Over the past decade there has been a major growth in the import of biological drugs, starting at 420M$ in 2010, this market has grown by a CAGR of 4.2% and is expected to continue along the same trend for the years to come.

There are over 70 biotech companies in Argentina developing human drugs showing the strong backbone and infrastructure in the development of generics and biosimilars. Many of these companies are exporters to emerging markets – mainly in Asia.

Pharma14 covers the Argentina market extensively. Monthly tracking of all marketing authorizations, pricing and manufacturing data.

Sample data: Argentina Lenalidomide 10 mg.

June 15, 2022

Baclofen for AUD treatment in France

Baclofen is an antispasmodic agent that induces muscle relaxation. It is mainly used to treat skeletal muscle spasticity and other types of severe muscle spasms, usually caused by multiple sclerosis and spinal cord injuries. The drug was initially intended to treat epilepsy; however, the results of the clinical trial were disappointing, and the drug was introduced to the market fifteen years later in 1977 as a treatment for muscle spasticity.

Baclofen is known for its off-label uses, most commonly its use as a treatment for alcohol use disorder (AUD). The matter of baclofen's efficiency in treating this disorder is quite unsettled. The clinical trials regarding the drugs usage as a treatment for AUD came back inconclusive; whereas the way baclofen works is still a mystery, moreover, the trials did not come up with any data to show that baclofen does or does not treat AUD. This uncertainty was enough for the FDA to disapprove of the drug's usage for anything other than muscle relaxation. However, the French drug agency (ANSM) decided to acknowledge the drug as a treatment for AUD, in condition that the patient be in high risk of failure of usage of other medicinal treatments and when the reduction of alcohol consumption be essential. The drug is to be reevaluated every 3 years and is then resubmitted to the French market.

Over 60,000 patients are currently treated with baclofen in France for AUD, most of whom at doses lower than 80 mg per day.

Total reimbursed Baclofen MOH 2021 was over 11 million USD.

Baclofen reimbursed France consumption data:

Sample France Baclofen pricing data:

June 01, 2022

Branded generics market - forecasting growth

Branded generic drugs are new-formulated versions of off-patent drugs, sold by the original manufacturer or by a generic drug company seeking to create a brand name for their generic version. This is in distinction from ordinary generics who do not seek a brand name, and market their generics by their chemical name. The branded generics market is worth two-thirds of the global generics market and was valued at $230.47 billion dollars in 2021. With sales growing at 8.9% CAGR, the market is expected to double in size by 2030.

Branded generics go through the same FDA approval process as other generics do after the original drug patents expires. Companies must submit an ANDA (abbreviated new drug application) to the FDA, proving bioequivalence to the original drug. Authorized generics, however, are created by the original manufacturer, under the same NDA (New Drug Approval) authorization as the original drug, and they may be sold before drug patents expire. In terms of price, both branded generics and authorized generics tend to cost more than ordinary generics, due to the branded generic's long approval process, and the authorized generic's market exclusivity.

The global generics market is primarily driven by the significant increase in cardiometabolic risk factors and in cancer cases thus raising the need for cheaper alternatives. In turn, governments are shifting towards implementing generic drugs in healthcare. In addition, the COVID-19 pandemic led to the implementation of stringent lockdown regulations across several countries, which are now being removed, reopening the market to generic distribution.

However, the main reason the branded generics market is expected to expand is due to Marketing and commercialization, having an enormous effect on the success of new drugs in the market. Marketing a name that consumers can remember easily, rather than a complicated chemical name, sparks loyalty and familiarity, and is why consumers stick to the same brand name. This is why the branded generic market still has a long way to go.

Sample pricing data: CRYSELLE (Norgestimate / Ethinylestradiol) US state tender and private.

1 June 2022.jpg)

Sample US Medicaid / Medicare 2016-2020 consumption data: CRYSELLE (Norgestimate / Ethinylestradiol)

US state tender and private 1 June 2022.jpg)

May 01, 2022

US Humira going off patent coming January 2023

The drug adalimumab, also known as blockbuster drug Humira, manufactured by AbbVie, is set to go off patent in the US in January 2023. With revenue peaking at 20.8 billion dollars in 2021, Humira is considered to be the world's top selling drug and has held that status for the past 8 years. Humira has generated a revenue total of 200 billion dollars over the years, since its release to the market in 2002.

To deter competition with its top seller drug, AbbVie sought to obtain as many patents as it could. Some of the patents claimed Humira, its uses, or its manufacturing processes. Other patents included ingredients, formulations, and/or processes that AbbVie did not use, but which an innovative biosimilar company might employ to make a competitor to Humira. AbbVie sought to patent the entire field of Humira biosimilars so as to foreclose any possible competition. In order to protect Humira's largest market- the US, AbbVie had arranged settlements with 8 manufacturing companies, allowing them to release their biosimilars in the EU in 2018, yet restraining them from releasing in the US until a designated date in 2023.

The first settlement closed was with Amgen regarding their biosimilar Amgevita. AbbVie agreed not to settle with any other manufacturers on terms that would let them enter the market at the same time as Amgen, or for five months thereafter, thus ensuring Amgen with Humira biosimilar exclusivity for the first five months it is on the market. The potential worth of these exclusive five months could mount up to several billions of dollars for Amgen, simply for withholding their version of Humira.

The other settlements that were made also allowed the release of the biosimilars in the EU market in 2018. However, the release date in the US market differs from one settlement to the next. With each settlement closed, the release date was pushed back by a few months, guarantying the former settler a few months of market exclusivity, along with the companies who have made an agreement with AbbVie beforehand.

In this manner, AbbVie had gained complete control over the adalimumab market, merging generics gradually into the market, allowing AbbVie to manipulate their prices and marketing strategies to suit the market they have constructed.

Sample pricing data: US tender (Humira) vs. Germany (Amgevita) vs. Germany (Amgevita) 1 May 2022.jpg)

April 01, 2022

Revlimid vs generic lenalidomide. Swift price drop.

The blockbuster drug lenalidomide, sold under the trade name Revlimid, has been used to treat multiple myeloma, smoldering myeloma, and myelodysplastic syndromes (MDS) since it was approved by the FDA in mid-2007.

Originally patented by Celgene, (who was acquired by Bristol Myers Squibb in 2019), Revlimid had generated a major profit of $1.6 billion in just the first year, peaking its revenue at roughly $14 billion dollars annually in 2021.

However, sales of the blockbuster drug came in below expectations this year a $2.6 billion in the first quarter, compared with $2.8 billion a year ago. This is due to the drug going off patent in early 2022, bringing along generic competition. With the expectancy of new generic drugs flooding the market, BMS expects sales of Revlimid to drop to between $9 billion and $8.5 billion this year.

So far, we have seen some generics enter the market- Teva pharmaceuticals announced the release of its generic version of Revlimid, (the first to release in the US), Novartis' Sandoz has released its version in Europe and Canada, and Accord Healthcare has released its version in the UK. Many other companies are set to launch Revlimid generics this year in the U.S., including Indian firms Natco Pharma, Sun Pharma, Zydus Cadila, Cipla and Dr. Reddy’s Laboratories.

Many of these companies struck limited deals with BMS, agreeing to hold back the launch of their version. And although the introduction of generics usually puts downward pressure on prices, limited-volume deals such as these will not impact prices as much.

Pharma14 global pricing database tracks all marketing authorizations in over 68 countries with standard monthly updates.

Sample data (Spain): Revlimid vs generics. 10 mg - 21/pack. Over 75% price drop at generic launch.

March 01, 2022

Clinical trials - global supply market

The global clinical trial supply market’s size was valued at 2.3 billion USD in 2021 and is expected to expand at a compounded annual growth rate (CAGR) of 6.9% from 2022 to 2030. The growth is attributed to globalization, a rise in the number of clinical trials and an increase in the number of biologics & biosimilar drugs in clinical trials.

The clinical trial supply market is divided into three major categories. These include manufacturing, storage & distribution and supply chain management. The manufacturing segment is anticipated to witness the fastest CAGR of 7.4% during the forecasted period.

Moreover, being that total healthcare costs have increased due to high-priced patented pharmaceutical drugs, especially biologics, governments are pushing towards the development of biosimilar drugs. These drugs intend to offer comparable safety and efficacy relative to reference brand biologicals.

Biosimilar clinical trials require class-specific regulatory approval pathways, and their average cost break over a biologic clinical trial ranges only from about 10% to 20%, leaving plenty of profit for both the original biologic and the biosimilar developers.

The expected growth in both these markets alongside the pharmaceutical drug clinical trial supply market, which accounts for the highest number of drugs in the clinical trial segment, is said to propel a major growth in the clinical trial supply market globally.

We at Pharma14 are proud to be one of the leading data basing platforms used by many clinical trial supply companies.

Sample data: Adalimumab biosimilars sample data.

February 01, 2022

68 country medicine wholesale price tracking

Price is one of the key competitive dimensions of purchasing a product. As pharma companies, pharmacy chains, insurers, hospitals and outpatient clinics are eager to have access to better price information, Pharma14 global medicine and pricing database comes into play.

One of the leading price indicators is the wholesale pricing structure and levels.

Wholesale prices can vary quite substantially between similar markets in the EU and even in the EU5.

Besides Ex-factory and retails price levels, Pharma14 is also currently tracking wholesale prices in 68 countries.

With the Pharma14 platform tracking wholesale price movement has never been easier.

Our 30 day standard updated database makes keeping tabs on the wholesale price movement practical and efficient.

Sample data: Wholesale price comparison of Teriparatide in Spain, Italy and France. May 2022.

January 01, 2022

New Zealand medicine and pricing information added to Pharm14

Pharma14 is pleased to announce the addition of New Zealand to our growing list of countries on our medicine data and pricing platform.

The New Zealand pharmaceutical market is characterized by its extremely well regulated system of pharmaceutical coverage across the country, with lower patient co-payments than many other similar countries.

New Zealand does not use levied price controls to determine the countries drug princes. Instead, prices are determined by negotiation via the Pharmaceutical Management Agency of New Zealand.

To achieve favorable pricing for pharmaceutical stakeholders, the Pharmaceutical Management Agency of New Zealand. uses a variety of techniques including competitive tendering, sole supply contracts and reference pricing to encourage a successful pharmaceutical market.

New Zealand is a well-established country to manufacture products in, making it very attractive to private companies and consumers alike, with around 55 companies in the country engaging in the production of both Finished Dosage Forms and API’s, with Adalimumab (1) being the top API used by cost by New Zealand citizens in 2019.

Currently, the market in New Zealand is valued at a figure of around $985 million USD, with a large proportion of that figure being comprised of Rx products. There are also over 900 pharmacies in New Zealand that dispense over 50 million prescriptions per year, revealing New Zealand to be a fantastic country for manufactures of prescription drugs and products to establish new facilities there.

Pharma14 is a monthly updated platform that allows you to view and track registered medicines in over 66 countries including New Zealand in real time.

Our integrated advanced search module allows you to compare worldwide markets, including manufacturing information, pricing details, product names, active ingredients, MA holder data, reporting dates and much more.

Sample data: Adalimumab February 2022 data.

December 01, 2021

EU and Japan are victims of global drug shortages

The global issue of shortages in drug supply is one that has been exacerbated by the COVID-19 pandemic.

Due to this, governments around the world are finding it increasingly difficult to mitigate this concern and keep up with the high demand of several API’s and raw materials to meet this growth in consumer demand.

In this instance, Japan and the EU are finding it particularly difficult to increase the production of generic drugs to relieve the pressure on the pharmaceutical supply chain.

So far in 2022, Japan has seen a shortage of more than 2,000 generic drugs.

Between the years of 2000 and 2018, drug shortages in the EU have witnessed a 20 fold increase for reasons ranging from manufacturing problems to pricing issues.

By virtue of Europe’s over-reliance on overseas API manufacturing, the EU are now encouraging Member States to produce and manufacture API’s in their respective local countries to reduce the dependency on their neighboring counterparts as 80% of API’s are already being sourced from outside the European Union.

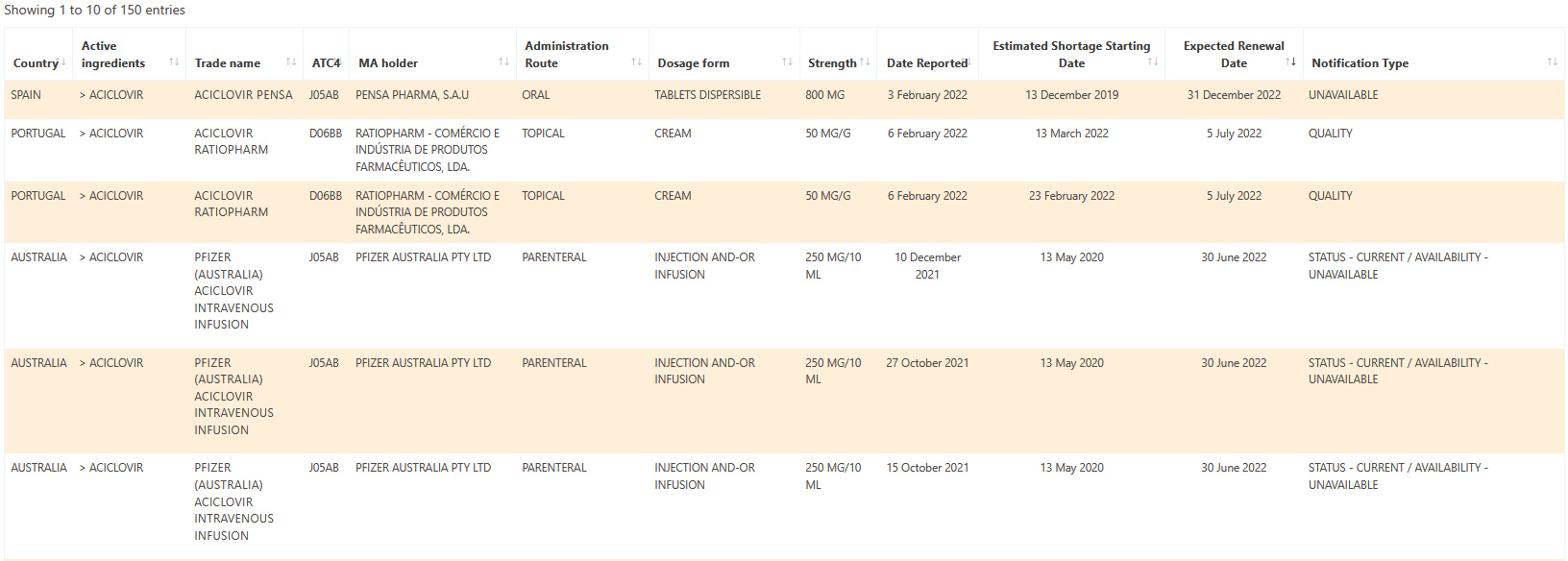

Pharma14 has an integrated Medicine Shortages module that allows you to view, track and compare worldwide drug shortages, easily defined by each country.

The data tracks the product name, API, reporting date, estimated renewal date, the reason for the shortage and much more presented in real time, all in one place.

Having this information allows you to expand your geo-economic position without relying on multiple streams of data.

Sample shortage data: Aciclovir.

November 01, 2021

Biosimilar medicine policy in Colombia

Many diseases have been combatted by the development and manufacturing of biological drugs. However, the cost to create such treatments is usually so great that the development and approval of similar biotherapeutic products is a lifeline in developing countries, where many patients are facilitated access to these drugs.

For instance, the Columbian Ministry of Health has issued guidelines that include all the similar biotherapeutic products and was established under the premise that the ability to compare studies on these drugs are the foundation of the development of these biosimilars.

The importance of tracking and comparing biosimilars in this way has rendered itself extremely significant in countries like Columbia, where guidelines for competing biological drugs are the cornerstone of a fair pharmaceutical market for consumers and stakeholders who want to manufacture similar biological drugs in different markets.

By being able to compare the different drugs, patients and stakeholders alike are certainly guaranteed to find the best drug alternative to suit their needs for a variety of prices, as guides like the one published by the Columbian government guarantee a high similarity in the quality, functionality level and physiochemical properties of each comparable drug.

Pharma14’s integrated Advanced Search Module allows you to track and compare worldwide markets such as Columbia, including data on prices, active ingredients, manufacturing information, MA holder data, reporting date and much more. Our coverage of reimbursed medicine statuses and our innovative market access tools are all updated monthly to give your business the most current picture of the pharmaceutical market.

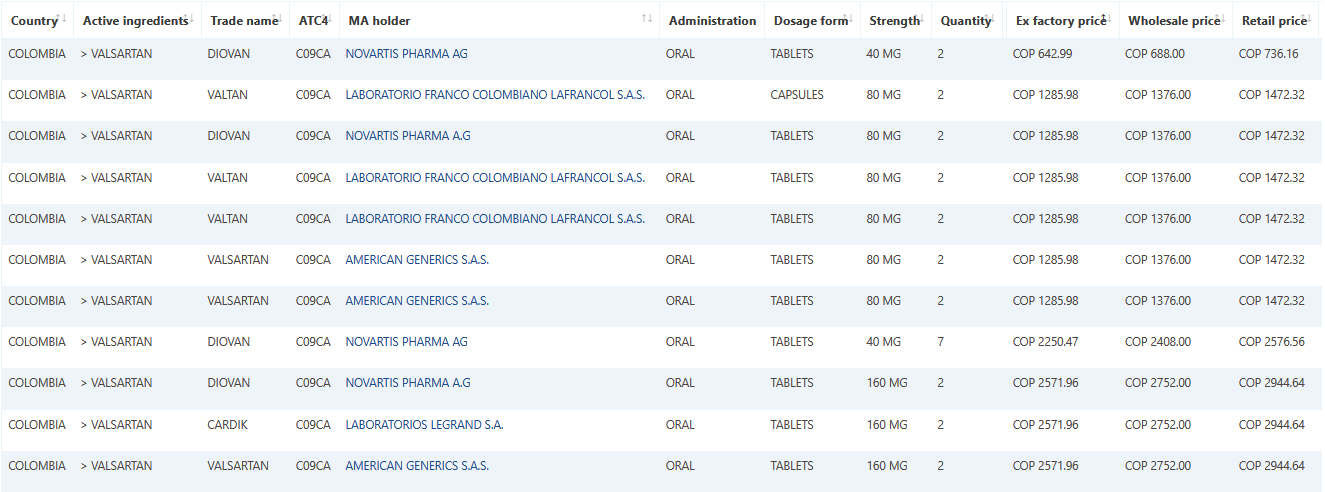

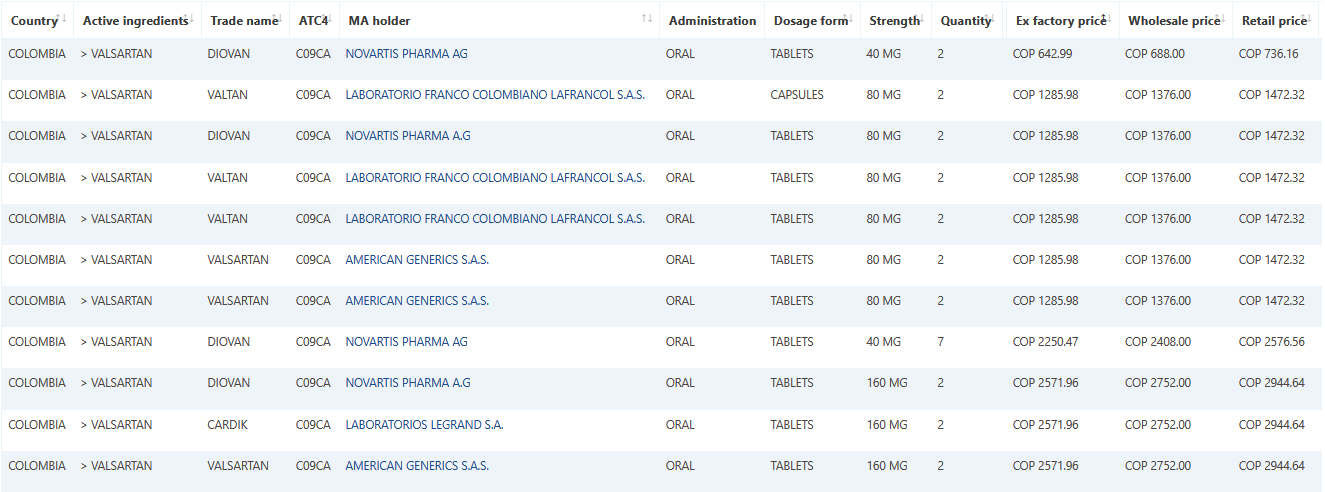

Sample data: Valsartan December Colombia data.

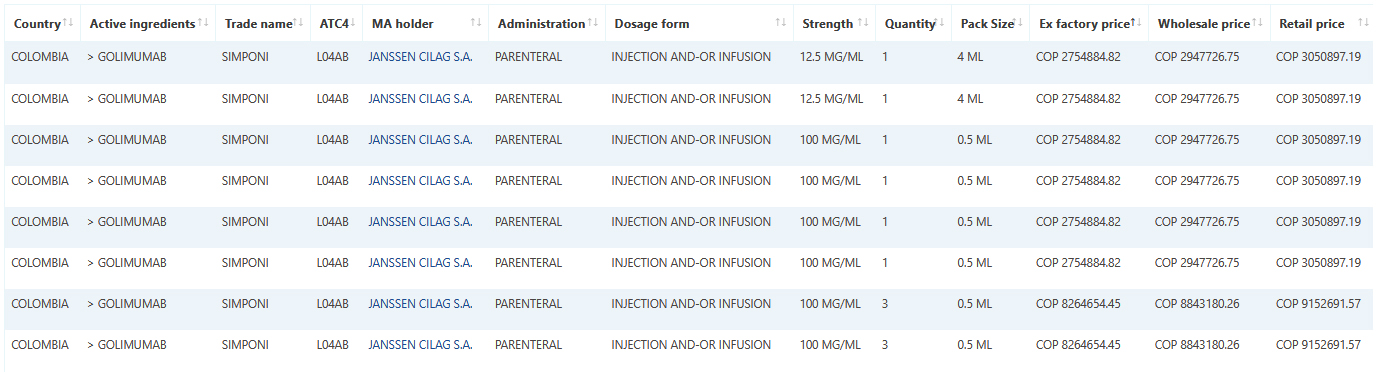

Sample data: Simponi / Golimumab December Colombia data.

October 01, 2021

Bahrain medicine and pricing information added to Pharma14

Pharma14 is pleased to announce the addition of Bahrain to our list of countries on our growing medicine data and pricing platform.

The Bahraini pharmaceutical market is distinguished from its regional counterparts by its high level of imported pharmaceutical products, which provides incomparable opportunities for international business in the Middle East.

The Bahrain pharmaceutical industry is valued at a figure of over $260 million USD, and is the largest contributor to GDP in the region in comparison to its neighboring countries, and the country is also ranked in second place in

the region in terms of pharmaceutical sales per capita, revealing tantalizing investment opportunities for pharmaceutical companies.

Due to the dependency on imported products, domestic production of drugs only holds a small percentage of national supply, and market demand is usually facilitated through importation.

Whilst some investments have been made in the local manufacturing facilities, imports continue to supply the majority of the share. Importantly, support for domestic manufacturing is mainly through pricing and reimbursement

policies that often differentiate themselves from multinational manufacturers.

Another point of contention is that key drivers in the Bahraini pharmaceutical industry are volume-based, as the growing population gradually needs more sophisticated drugs for contemporary diseases.

Bahrain therefore has a long term reward potential for pharmaceutical stakeholders looking to establish a working relationship with importers there.

Pharma14 is a monthly updated platform that allows you to view and track registered medicines in over 66 countries including Bahrain in real time.

Our integrated advanced search module allows you to compare worldwide markets, including product names, active ingredients, manufacturing information, MA holder data, reporting date and much more.

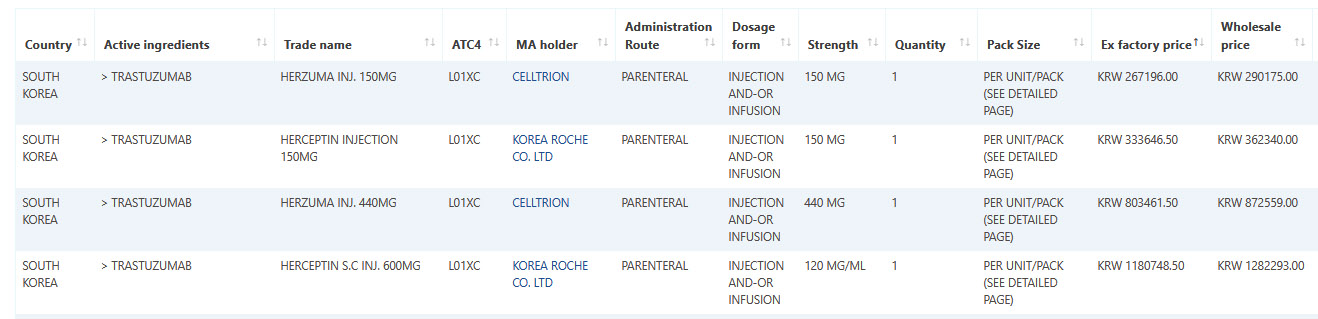

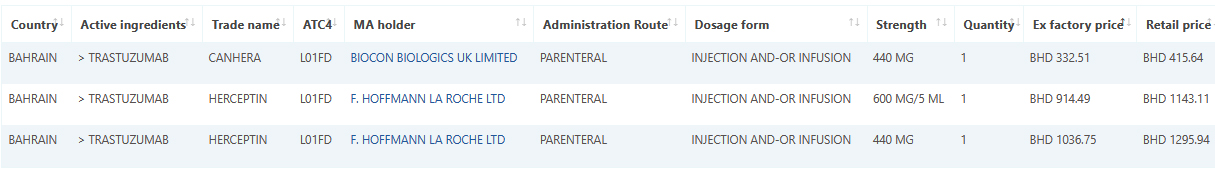

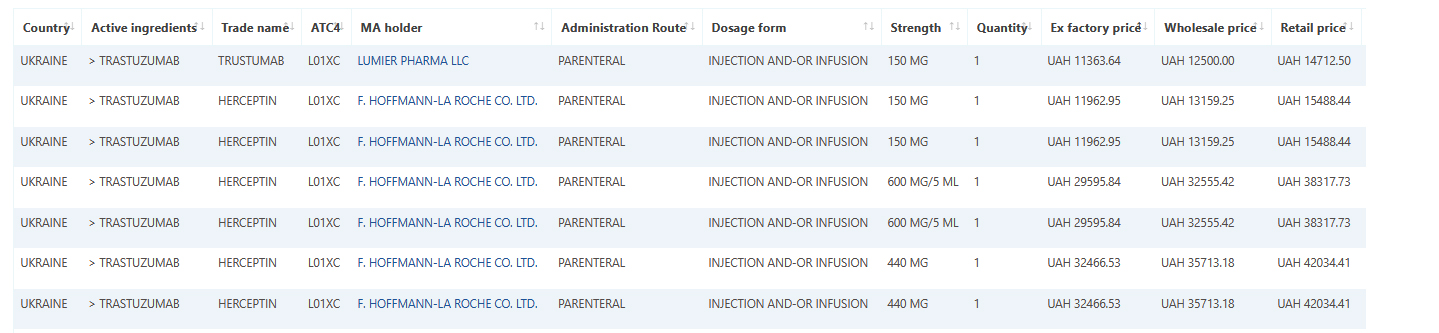

Sample data: Trastuzumab January 2022 data.

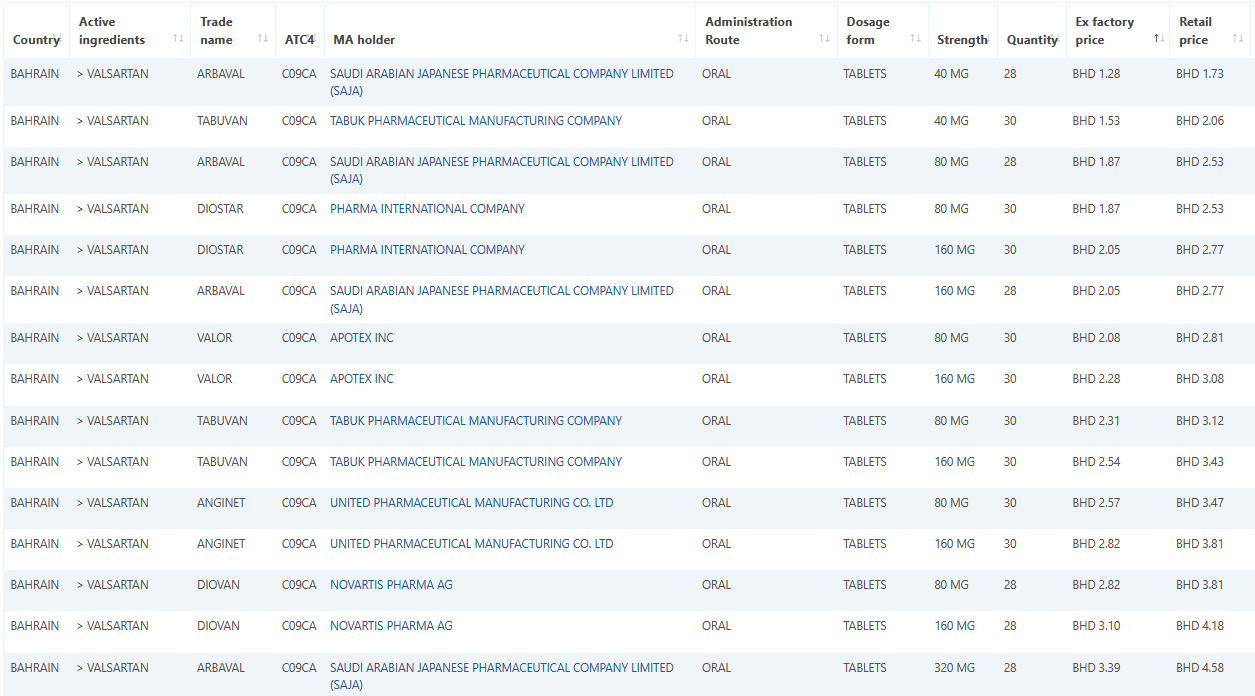

Sample data: Valsartan January 2022 data.

September 01, 2021

USA Medicine shortages are live on newest Pharma14 module

The global issue of drug shortages is one that has been highlighted and accelerated by the pandemic, and all types of drugs are liable to this matter.

The availability of medicine is often dependent on factors such as manufacturing, logistics, accessibility of raw materials, increased demand for products and the inconsistency of seasonal demand.

Due to COVID, governments around the world are finding it increasingly difficult to mitigate these circumstances and keep up with the extremely high demand of some COVID related medicines and supplies.

Recently in the pharmaceutical world, all eyes have been on the USA and in particular their handling of procuring COVID related drugs to successfully manage the tremendously high demand they’ve witnessed in the past year and a half. In comparison to this, in the last month alone, the drug Actemra ‐ molecularly known as Tocilizumab, has witnessed such a surge in demand that it reached critical level and as a result is now in shortage.

The drug was recently recommended by the World Health Organization to treat critically ill hospitalized COVID patients and since then, there has been an obvious worldwide demand for this drug.

The Pharma14 platform has an integrated drug shortage module that allows you to view, track and compare worldwide drug shortages, easily defined by each country.

The data tracks the product names, active ingredients, MA holder data, reporting date, estimated shortage starting date, expected renewal date and more, allowing you to track this data in real time, because our database is regularly updated.

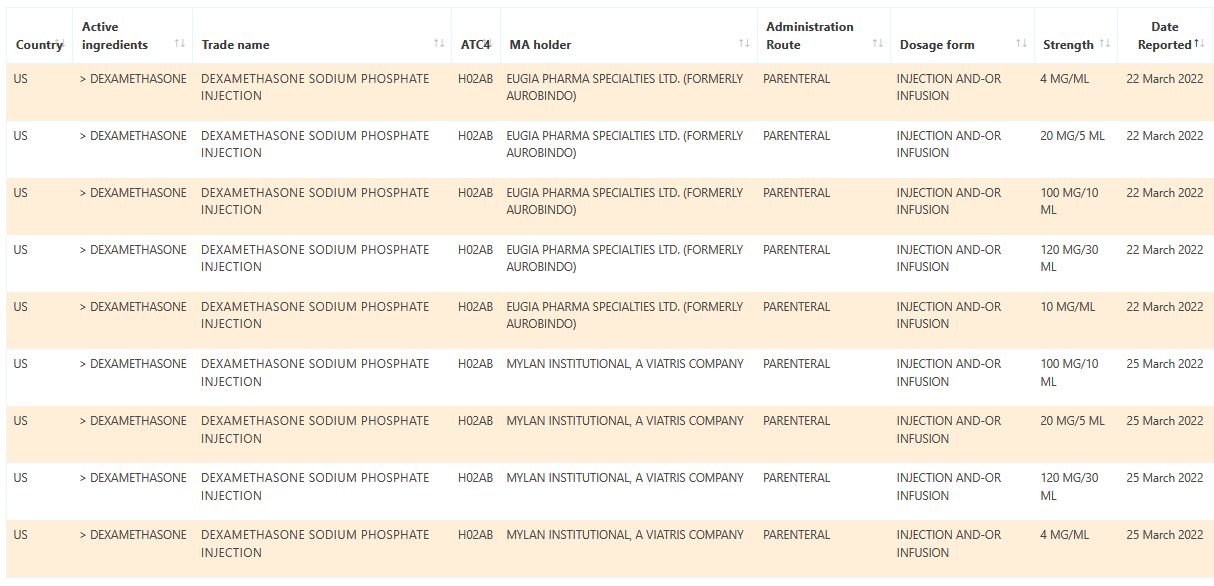

Sample data: Dexamethasone US shortages reported March 2022

August 24, 2021

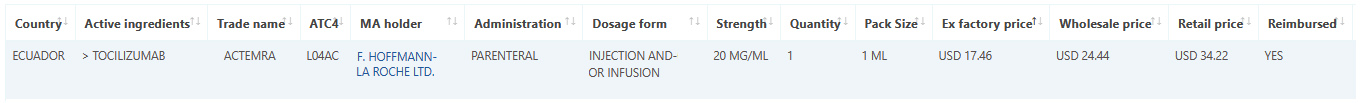

Ecuador medicine data and pricing added to Pharma14

August 09, 2021

Poland consumption and sales data are the latest additions to the Pharma14 platform

August 02, 2021

Medicine shortages module is live on Pharma14 platform

July 15, 2021

Ukraine medicine data and pricing added to Pharma14

June 15, 2021

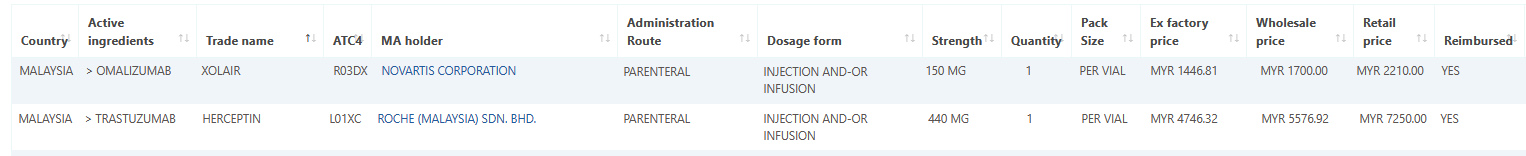

Malaysia medicine data and pricing added to Pharma14

May 15, 2021

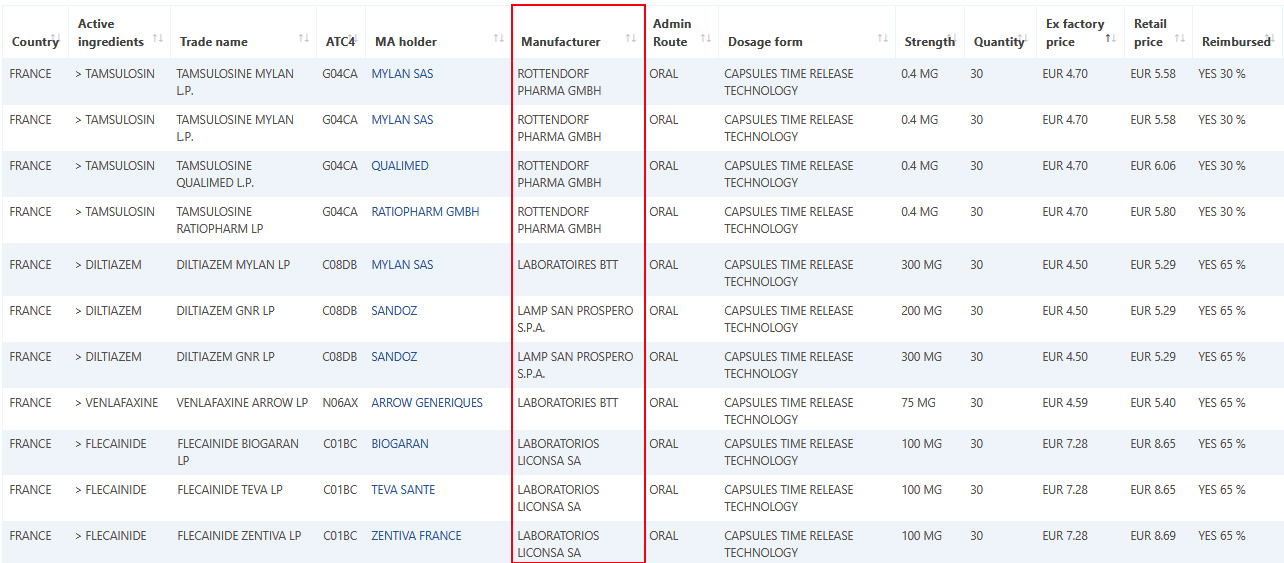

Over 150,000 French Marketing Authorizations manufacturer's information updated on Pharma14

April 15, 2021

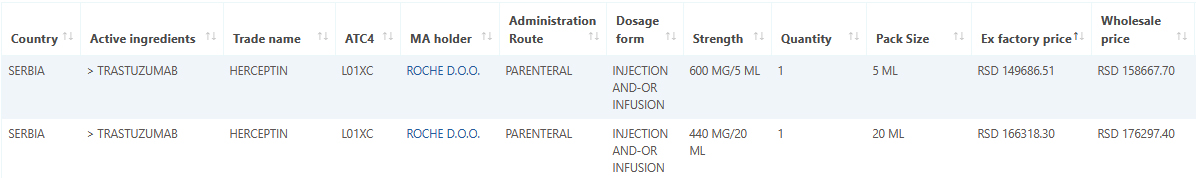

Serbia medicine data and pricing added to Pharma14

March 15, 2021

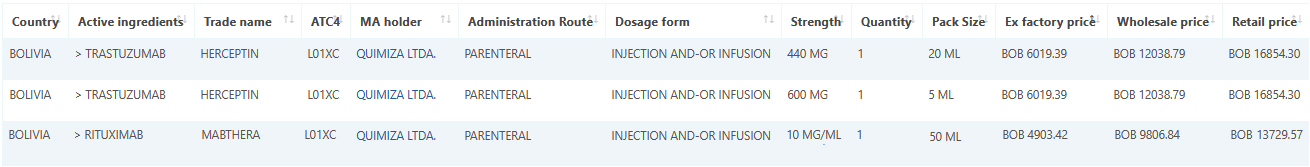

Bolivia medicine data and pricing added to Pharma14

Pharma14 is glad to be adding the medicine and pricing data for Bolivia starting February 1 2021.

Sample data: Herceptin and Mabthera February 2021 sample data.

February 15, 2021

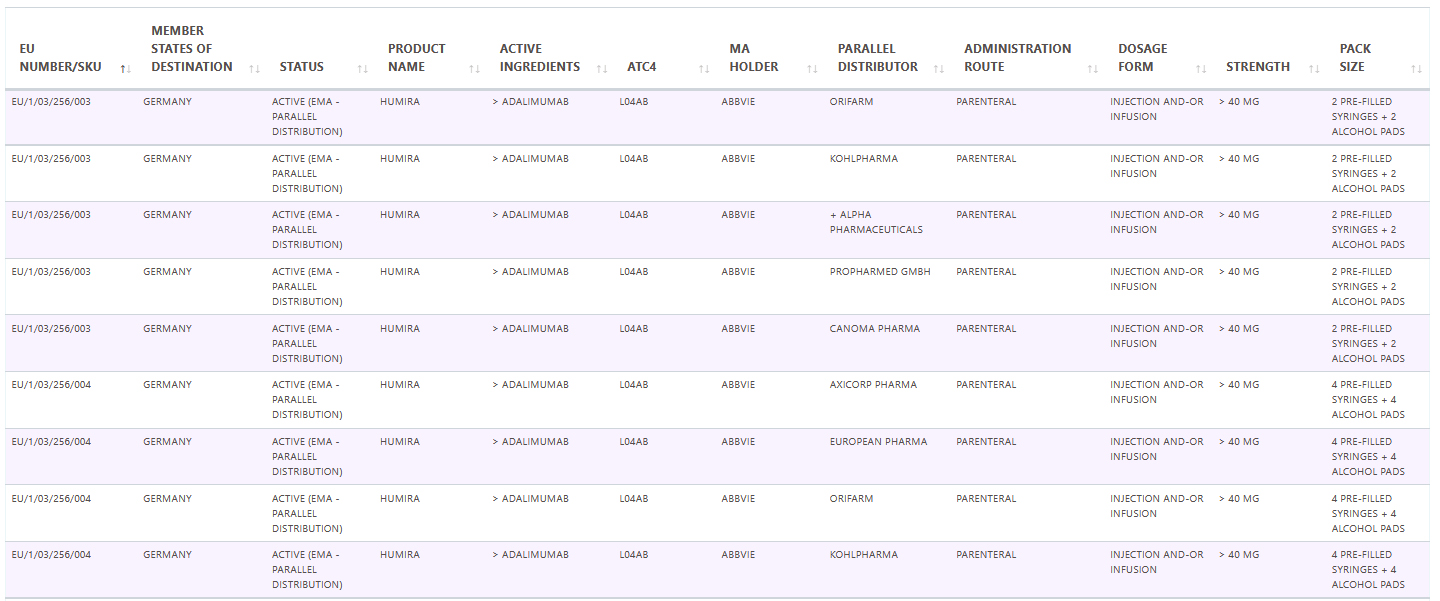

Pharma14 adding new EU Parallel Trade database module

Parallel trade is the distribution of an authorized medicinal product from one Member State to another by a pharmaceutical company independent of the marketing-authorization holder.

In the Single Market, parallel traders can buy pharmaceuticals in any EU/EEA country and then under regulated conditions move them to a destination country, repackage them and sell them at a lower cost than the standard local price, thus bringing them into competition with that same identical product sold by the manufacturer or its local licensee.

The turnover of EU parallel imports is estimated to reach approximately €6 billion by 2021.

Pharma14 is happy to be adding a dedicated Parallel Trade database and module that will be tracking these medicinal products on a national as well as on a pan European level.

Sample data: January 2021 Adalimumab / Humira in Germany.

January 17, 2021

Spanish hospital consumption data added to Pharma14

Tracking all medicine data and pricing in Spain since 2016 Pharma14 is glad to add the Spanish hospital consumption information to its platform.

The pharmaceutical market in Spain is expected to rise in value from $24.5 billion in 2016 to $26 billion by 2022,

This represents a compound annual growth rate of close to 1%.

Spain today stands as the tenth-largest pharma market in the world.

January 11, 2021

Peru medicine data and pricing added to Pharma14

Pharma14 is glad to be adding the medicine and pricing data for Peru starting January 1, 2021.

The data for Peru comprises over 10,000 registered MA's including monthly updated ex-factory, wholesale and retail prices.

Pricing included hospital as well as retail/pharmacy channel distribution with over 300 MA holding companies listed.

Sample data: Trastruzumab - Herceptin Janurary 2021 sample data.

Sample data: Insulin Glargine - Lantus Janurary 2021 sample data.

January 05, 2021

Indonesia medicine data and pricing added to Pharma14

December 03, 2020

Panama medicine data and pricing added to Pharma14

Pharma14 is glad to be adding the medicine and pricing data for Panama starting December 1.

Sample data: Lenalidomide - Revlimid December 2020 sample data.

Sample data: Insulin Glargine - Lantus December 2020 sample data.

November 16, 2020

Colombia medicine data and pricing added to Pharma14

Pharma14 is glad to be adding the medicine and pricing data for Colombia. Over 40,000 marketing authorizations, including Ex-factory, wholesale and retail pricing.

Sample data: Simponi / Golimumab October Colombia data.

Sample data: Valsartan October Colombia data.

Sample data: MARKET OPPORTUNITY LOCATOR.

Sample molecules with 1 marketing authorization holders per total market share.

October 15, 2020

Argentina medicine data and pricing added to Pharma14

Pharma14 is glad to be adding the medicine and pricing data for Argentina. Over 15,000 marketing authorizations, including Ex-factory, wholesale and retail pricing.

Sample data: Simponi / Golimumab October Argentina data.

Sample data: Valsartan October Argentina data.

Sample data: MARKET OPPORTUNITY LOCATOR.

Sample molecules with 2 MA holders per total market share.

September 18, 2020

Chile medicine data and prices are the newest additions to Pharma14

The Chilean pharmaceutical industry has experienced one of the strongest growth rates in Latin America in the last decade.

Indeed, the share of the Chilean pharmaceutical industry in GDP is about 1.2%, while exports represent 1.1% of total manufacturing industry.

Chilean imports: during the period 2012-2020, they increased by 14% to reach approximately $2 billion.

Trastuzumab sample data and pricing September 2020.

September 04, 2020

USA Marketing Authorizations Manufacturer Information On Pharma14

Pharma14 has updated Marketing Authorizations manufacturer information on 20,000 medicines in the USA database this month.

Furthermore many of the marketing authorizations now come with API manufacturer information as well.

This data is complementary to all other data such as MA holder, ex-factory, wholesale and retail pricing, consumption and more.

Sample data: Rocuronuim USA manufacturers.

August 20, 2020

Thailand medicine data and prices are the newest additions to Pharma14

The Thai pharma market, one of the largest in the ASEAN region, stood at USD 5 billion in size in 2016. Thailand projects that the market will grow to USD 7 billion in 2021 and USD 9.5 billion by 2026.

Thailand’s healthcare expenditure is projected to rise from USD 24.1 billion in 2016 to USD 45.5 billion by 2026,

In general, there are no specific regulations related to the pricing of medicines.

Medicine prices are regulated only when they are one of the approximately 1500 drugs on the National List of Essential Drugs (NLED).

Under the control of the Ministry of Commerce, drugs on the NLED are subject to a median price policy. Private hospitals and drug stores are free to set their own prices for the drugs they sell, but the price must not exceed the sticker price – the maximum price set by the distributor.

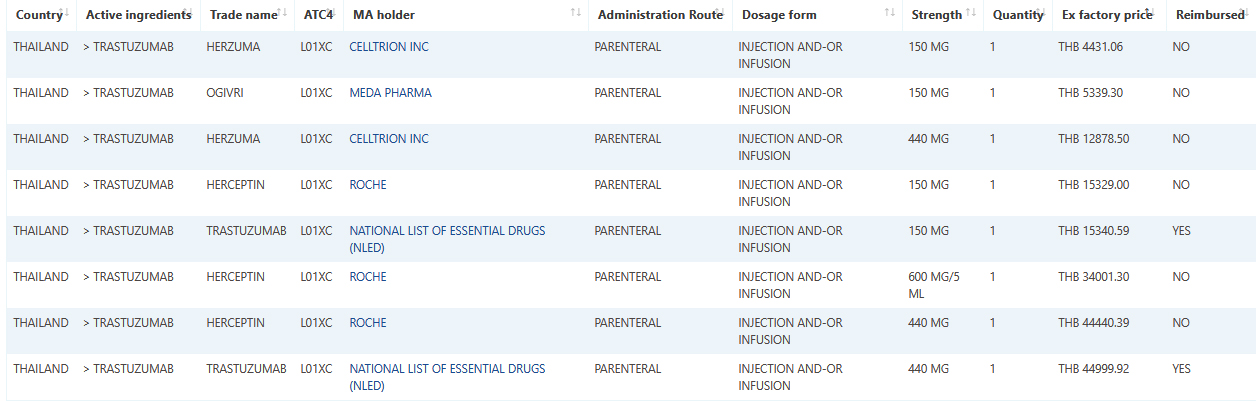

Trastuzumab sample data and pricing May 2020.

August 06, 2020

Pharma14 - Tracking monthly reimbursement status in 54 countries

Is one of your data needs and requirements the reimbursed status of medicines across Europe and other regulated and non-regulated markets?

Pharma14's coverage of reimbursed medicines status is updated on a monthly basis giving you the most up-to-date picture.

Our monthly updated platform will give you total reimbursed information for over 2,000,000 marketed medicines across 54 countries.

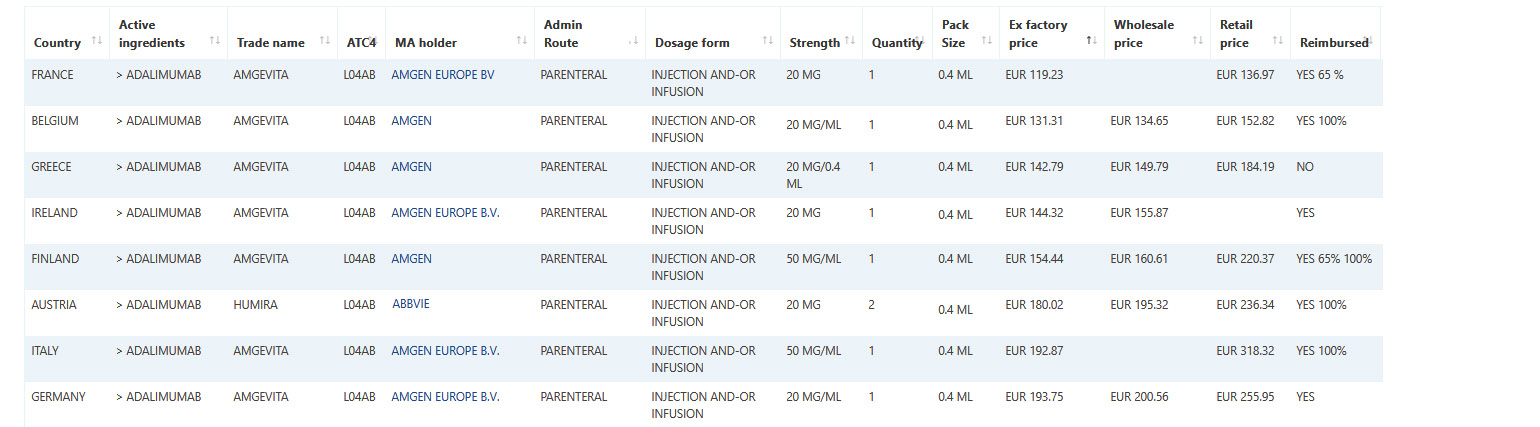

Sample data: Select Adalimumab prices and reimbursement status in Western European countries.

July 30, 2020

South Korea medicine data and prices are the newest additions to Pharma14

The South Korean pharmaceutical market is expanding and expected to reach more than 21 billion USD by 2021 with a compound annual growth rate (CAGR) of 2.5%, increasing from 18.6 billion USD in 2016.

The South Korean government is increasing its focus on introducing generics in order to reduce public costs.

This caused an even greater rise in the generic sector, forecasting an annual growth rate of over 7% compounded annually.

In international trade, pharmaceutical exports doubled to over 5 billion U.S. dollars in 2018. The bio-pharmaceutical sector continued to enjoy increased exports that were significantly higher than imports. Exports increased from around 400 million U.S. dollars in 2013 to almost 2 billion U.S. dollars in 2019.

Beginning this month Pharma14 has begun covering this exciting and large market in it's, monthly updated, global medicine and pricing database.